Well saidWho were they good for though? It seems odd to criticise one party’s idea of borrowing and spending in consideration to debt levels without mentioning how this also deserves criticism for being added to our debt levels and didn’t move the dial whatsoever for those most in need in a cost of living crisis

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Politics 🗳️ NZ Politics

- Thread starter wizard of Tauranga

- Start date

All relative to your mortgage repayments in regards to your savings. Bit late for me unfortunately in a marriage separation and ex wife ready to move on with me unable to buy her out. Banks certainly adjusted their lending risks over the past 5+ years. Not sure if this interest rate drop would have altered things but certainly disappointed as I’ll never own a place like this again with what has been put in. In regards to rentals, there’s also plenty sitting empty because of the high rent asked and some resorting to living in their cars or going back home to live with parents or friendsInflation is still low with things like petrol and food going down to offset rates and insurance. Families with big mortgages will be hundreds of Dallas a week better off when they next refix.

The surplus of housing is in an oversupply of units causing rent to rise (irrespective of house pricing). There was a massive amount of units built in central cities and now the population isn’t rocketing up. An oversupply indicates in some areas we don’t need much more new housing.

Just as annoying is the number of renters who had now had to vacate properties because their landlords are flogging them off as they could be bothered upgrading the properties to the Healthy Homes Standards. As a landlord, you've got certain obligations and cutting and running because you were too lazy to do right by your tenants.All relative to your mortgage repayments in regards to your savings. Bit late for me unfortunately in a marriage separation and ex wife ready to move on with me unable to buy her out. Banks certainly adjusted their lending risks over the past 5+ years. Not sure if this interest rate drop would have altered things but certainly disappointed as I’ll never own a place like this again with what has been put in. In regards to rentals, there’s also plenty sitting empty because of the high rent asked and some resorting to living in their cars or going back home to live with parents or friends

There was the article a few weeks ago I posted about a Masonic Trust in Napier doing this and now evidence that a lot of others are too.

There are some shocking renters, but there are some amazing ones too who treat the house as their own with care and respectJust as annoying is the number of renters who had now had to vacate properties because their landlords are flogging them off as they could be bothered upgrading the properties to the Healthy Homes Standards. As a landlord, you've got certain obligations and cutting and running because you were too lazy to do right by your tenants.

There was the article a few weeks ago I posted about a Masonic Trust in Napier doing this and now evidence that a lot of others are too.

- Thread starter

- #16,905

The biggest risk is Labour and the Greens get in and make it uneconomic again.Just as annoying is the number of renters who had now had to vacate properties because their landlords are flogging them off as they could be bothered upgrading the properties to the Healthy Homes Standards. As a landlord, you've got certain obligations and cutting and running because you were too lazy to do right by your tenants.

There was the article a few weeks ago I posted about a Masonic Trust in Napier doing this and now evidence that a lot of others are too.

That’s the real risk and why people are getting out and not buying rentals. Unintended consequences.

Why invest in something that a govt can literally make unviable because that feel like it? All investment requires a level of certainty to base decisions off that Labour has destroyed.

Don’t blame the landlords for reacting to the market conditions our leaders have set…

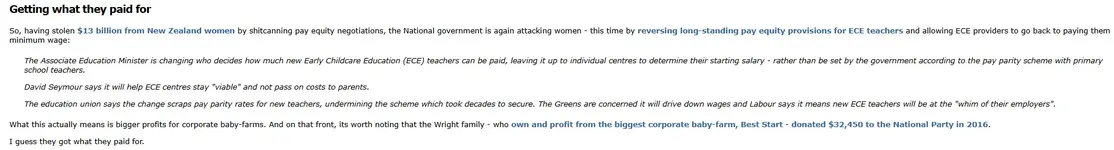

Getting what they paid for

So, having stolen $13 billion from New Zealand women by shitcanning pay equity negotiations, the National government is again attacking wom...

That’s such a weird graph. Look at the groups at the bottom.

The first group - a range of $100k

The second group- a range of $50k

The third - a range of $100k

The fourth - a range of $750k

The last - unlimited range

You can tinker with the groups to form any sort of conclusion you want the reader to draw

Property market is artificially inflated by all the renters recieving hundreds p/week in Accommodation Supplement, and indirectly through Working for Families topping up wages. Property investors and banks being the major beneficiaries. Do I have that right?The biggest risk is Labour and the Greens get in and make it uneconomic again.

That’s the real risk and why people are getting out and not buying rentals. Unintended consequences.

Why invest in something that a govt can literally make unviable because that feel like it? All investment requires a level of certainty to base decisions off that Labour has destroyed.

Don’t blame the landlords for reacting to the market conditions our leaders have set…

- Thread starter

- #16,912

1 - is capital gains earned?

2 - does that graph deducting the economies inflation from the gain as it’s capital inflation as much as gains?

3 - does it deduct lending on the capital?

4 - NZ has had capital losses on property and shares the last few years, so this is not accurate in a NZ context?

5 - most of the rich earn from drawings/ dividends which is not included in there?

6 - some capital gains in NZ has tax paid on it - eg brightline, intention rules, etc. This doesn’t seem to be clarified in this misinformation piece?

That’s such a weird graph. Look at the groups at the bottom.

The first group - a range of $100k

The second group- a range of $50k

The third - a range of $100k

The fourth - a range of $750k

The last - unlimited range

You can tinker with the groups to form any sort of conclusion you want the reader to draw

The super tax debate is divorced from reality – and more proof that Australia’s tax system is built for the rich | Greg Jericho

The proposal will affect only 0.5% of people with superannuation and yet you would think the government is about to seize the means of production

1 - is capital gains earned?

2 - does that graph deducting the economies inflation from the gain as it’s capital inflation as much as gains?

3 - does it deduct lending on the capital?

4 - NZ has had capital losses on property and shares the last few years, so this is not accurate in a NZ context?

5 - most of the rich earn from drawings/ dividends which is not included in there?

6 - some capital gains in NZ has tax paid on it - eg brightline, intention rules, etc. This doesn’t seem to be clarified in this misinformation piece?

View: https://bsky.app/profile/australiainstitute.org.au/post/3lqbgnogjgc2c

The super tax debate is divorced from reality – and more proof that Australia’s tax system is built for the rich | Greg Jericho

The proposal will affect only 0.5% of people with superannuation and yet you would think the government is about to seize the means of production

Yup, i think I read somewhere that 65% of New Zealanders are receiving a benefit of some sort. This may be super or working for families or unemployment or accommodation supplement but it's a sad indictment on where we are as a countryProperty market is artificially inflated by all the renters recieving hundreds p/week in Accommodation Supplement, and indirectly through Working for Families topping up wages. Property investors and banks being the major beneficiaries. Do I have that right?

Smells like communism Rick, should we cut the accom supplement and crash the property market?Yup, i think I read somewhere that 65% of New Zealanders are receiving a benefit of some sort. This may be super or working for families or unemployment or accommodation supplement but it's a sad indictment on where we are as a country

And going back to Plato, Socrates et al. If you don't have a rich, how can you have a poor?

If you don't have death, life would lose it's meaning.And going back to Plato, Socrates et al. If you don't have a rich, how can you have a poor?

Absolutely. lol. Nah, I don't subscribe to the " everyman for himself" doctrine. I have friends who wouldn't be able to rent a decent small flat without that subsidy. Not necessarily their fault, just circumstances in many cases.Smells like communism Rick, should we cut the accom supplement and crash the property market?

To correlate that, the only real answer to the housing problem is for the state to build mega accommodation blocks a la Soviet era, house everyone and repress the individual spirit.

Tough Gig

Death is a portion of circumference on the wheel of lifeIf you don't have death, life would lose it's meaning.

Jesus wept, some heavy shit going down now on the Thirsty Thursday

Similar threads

Current Affairs

🗳️ Is this the twilight of democracy?

- Replies

- 160

- Views

- 32K

- Replies

- 3

- Views

- 3K