Actually I suppose the solution is slash public spending wherever possible regardless of the backlash, right voting electorate won't mind because left bad and woke etc, looks good for balancing the books. Should have 6 years free reign before the tide turns, and on we go.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Politics 🗳️ NZ Politics

- Thread starter wizard of Tauranga

- Start date

Even the dumbest boomers probably know deep down that they won’t see any positive improvements from this government, Bill English and Stephen Joyce are not coming back, reduced to the egg man, crusher and some stooges. property investors would be what, 10% of the voting population? and all of this slash and burn is for them, to grow the economy by making owning rentals more attractive? And a paltry tax cut that will be eaten up by fuel taxes and probably a GST increase coming.Actually I suppose the solution is slash public spending wherever possible regardless of the backlash, right voting electorate won't mind because left bad and woke etc, looks good for balancing the books. Should have 6 years free reign before the tide turns, and on we go.

But y’know stopping handouts to the murries and that nasty woman is gone so fair trade???

Yeah sorry, been lucky in life - come from fuck all and done alright. Older posters will remember that I was the GM of a major international construction company back in the day, now a semi-retired consultant with my own company.

Probably why I don't want to pull the ladder up behind me - would never have got where I did without free school dinners, free university education, free health care (including dentistry as a kid) etc.

Te Pāti Māori seeks cross party support to remove GST on kai

Co-leader Rawiri Waititi has written to all MPs seeking their support for food bill.

better yet, why not subsidize all NZ fresh meat, fruit, vegetables, whole foods by putting heavy taxes on all these big overseas fast food chains that are killing the people that can least afford to be eating them anyway.

it’s cheaper to eat real food than that crap.

the amount of kids i see with pies and a giant can of V before AND after school,

no wonder a lot of them don’t eat these lunches being taken away.

also maybe the lunches should be more targeted and of higher quality.

Last edited:

Where is the evidence a lot of them don't eat these lunches? If anything the majority are eating the number of lunches that are made.no wonder a lot of them don’t eat these lunches being taken away.

Te Pāti Māori seeks cross party support to remove GST on kai

Co-leader Rawiri Waititi has written to all MPs seeking their support for food bill.www.nzherald.co.nz

also maybe the lunches should be more targeted and of higher quality.

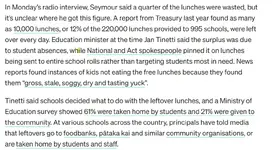

Taken from: https://thespinoff.co.nz/kai/06-03-...nches-what-are-they-eating-and-whats-the-cost

fair enough, what you posted there sums it up yeah. i didn’t know 12% of them weren’t even being eaten for lunches, or that out of that, 21% weren’t even going to school kids though.Where is the evidence a lot of them don't eat these lunches? If anything the majority are eating the number of lunches that are made.

View attachment 6293

Taken from: https://thespinoff.co.nz/kai/06-03-...nches-what-are-they-eating-and-whats-the-cost

i didn’t say the meals were being wasted, just that a lot of kids weren’t eating them, and that’s why i said maybe they should be more targeted and of higher quality.

Where are they getting the figures from, 10,000 of 220,000 isn't 12%.Where is the evidence a lot of them don't eat these lunches? If anything the majority are eating the number of lunches that are made.

View attachment 6293

Taken from: https://thespinoff.co.nz/kai/06-03-...nches-what-are-they-eating-and-whats-the-cost

If 61% of the 10,000 are being taken home - that reduces the 'waste' amount to 3,900, which is being reported to go to the community via food banks etc. An in school wastage rate of 1.7%.

Fuck me - this is what a successful govt initiative looks like.

Why aren't they crowing about the take up rate of 98.3%? Because they don't give a fuck about kids who need lunches.

Agreed, it seems to be very successful going off these numbers.Where are they getting the figures from, 10,000 of 220,000 isn't 12%.

If 61% of the 10,000 are being taken home - that reduces the 'waste' amount to 3,900, which is being reported to go to the community via food banks etc. An in school wastage rate of 1.7%.

Fuck me - this is what a successful govt initiative looks like.

Why aren't they crowing about the take up rate of 98.3%? Because they don't give a fuck about kids who need lunches.

Seymours argument that this initiative does not reduce absenteeism seems a bit convoluted, I think students going absent and students going hungry are separate issues.

Lunches should be available across the board. Swedish research found that children who ate their school meals improved their educational outcomes and were also healthier as they grew up. "Children from families in the lowest income quartile who received free school meals for nine years increased their lifetime income by 6%, resulting in a benefit to cost ratio of 7:1."

Te Pāti Māori seeks cross party support to remove GST on kai

Co-leader Rawiri Waititi has written to all MPs seeking their support for food bill.www.nzherald.co.nz

better yet, why not subsidize all NZ fresh meat, fruit, vegetables. whole foods by putting heavy taxes on all these big overseas fast food chains that are killing the people that can least afford to be eating them anyway.

it’s cheaper to eat real food than that crap anyway.

the amount of kids i see with pies and a giant can of V before AND after school,

no wonder a lot of them don’t eat these lunches being taken away.

also maybe the lunches should be more targeted and of higher quality.

absolutely, you’ll get no arguement from me on it.Lunches should be available across the board. Swedish research found that children who ate their school meals improved their educational outcomes and were also healthier as they grew up. "Children from families in the lowest income quartile who received free school meals for nine years increased their lifetime income by 6%, resulting in a benefit to cost ratio of 7:1."

Last edited:

You're not alone and philanthropy comes with the journey and position I'm betting.Yeah sorry, been lucky in life - come from fuck all and done alright. Older posters will remember that I was the GM of a major international construction company back in the day, now a semi-retired consultant with my own company.

Probably why I don't want to pull the ladder up behind me - would never have got where I did without free school dinners, free university education, free health care (including dentistry as a kid) etc.

Not trying to bait you but I was wondering, how do you think people with an income of your size would not receive a tax cut with the changes in the thresholds for the tax brackets? Increase the top tax bracket? Make it so people with an income over a certain amount stay on the current tax brackets while those below it get the adjusted brackets? Or not have any changes at all to the brackets so those on low to medium incomes don't receive any tax cuts along with high salary earners?Yeah sorry, been lucky in life - come from fuck all and done alright. Older posters will remember that I was the GM of a major international construction company back in the day, now a semi-retired consultant with my own company.

Probably why I don't want to pull the ladder up behind me - would never have got where I did without free school dinners, free university education, free health care (including dentistry as a kid) etc.

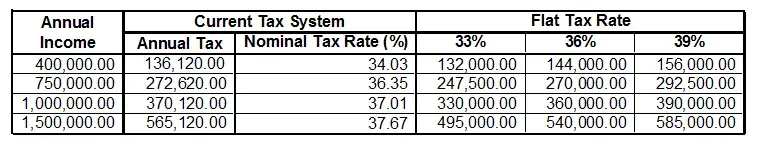

Maybe the way to do it is to remove the tax progressions for people once their income reaches a certain level and they then pay 33% (or 36% or 39%) but on their entire income and not the current tiered system just for them. At the moment, someone on an income of $400,000 PA pays $136,120 in income tax PA.

If it was a flat tax for people earning over $180,000 PA, their taxes would be something like this under a flat tax rate over their entire income:

While I think most people think that the free lunches lead to better outcomes for children, I still haven't seen why Labour only provided for it in their budget until the end of this year. I know it was being paid for by the COVID fund (which has now run out) but surely Labour, if they had wanted it to continue, would have found a way to pay for it.

I don't think that obviously - I object to the proposed tinkering (not tinkering per se, as certain tinkering could tax high earners more and lower earners less).Not trying to bait you but I was wondering, how do you think people with an income of your size would not receive a tax cut with the changes in the thresholds for the tax brackets? Increase the top tax bracket? Make it so people with an income over a certain amount stay on the current tax brackets while those below it get the adjusted brackets? Or not have any changes at all to the brackets so those on low to medium incomes don't receive any tax cuts along with high salary earners?

Maybe the way to do it is to remove the tax progressions for people once their income reaches a certain level and they then pay 33% (or 36% or 39%) but on their entire income and not the current tiered system just for them. At the moment, someone on an income of $400,000 PA pays $136,120 in income tax PA.

View attachment 6294

If it was a flat tax for people earning over $180,000 PA, their taxes would be something like this under a flat tax rate over their entire income:

View attachment 6295

Furthermore, our tax system is unfair and benefits both high earners and people with rich parents (especially when they die*).

*The parents I mean

Come on Mike - you're better than this!

What I was meaning is how can adjustments to the thresholds be made without giving more to the rich? Even if we said that the first $24,000 wasn't taxed, unless there was an adjustment to the top rates, the rich would benefit from having the same reduction in their tax bill of $3,220 PA as someone on the median wage.I don't think that obviously - I object to the proposed tinkering (not tinkering per se, as certain tinkering could tax high earners more and lower earners less).

Furthermore, our tax system is unfair and benefits both high earners and people with rich parents (especially when they die*).

*The parents I mean

Come on Mike - you're better than this!

I can't really see a way of reducing income tax without it still benefiting those on higher wages/salaries unless those changes didn't come in for them which does away with the simplicity of the current system or increasing the higher thresholds.

In terms of having rich parents, I've always favoured a gift duty and inheritance tax to reduce the amount of intergenerational wealth transfer.

Totally agree - I don't care whether its CGT, wealth or gift/inheritance but intergenerational wealth should be taxed.What I was meaning is how can adjustments to the thresholds be made without giving more to the rich? Even if we said that the first $24,000 wasn't taxed, unless there was an adjustment to the top rates, the rich would benefit from having the same reduction in their tax bill of $3,220 PA as someone on the median wage.

I can't really see a way of reducing income tax without it still benefiting those on higher wages/salaries unless those changes didn't come in for them which does away with the simplicity of the current system or increasing the higher thresholds.

In terms of having rich parents, I've always favoured a gift duty and inheritance tax to reduce the amount of intergenerational wealth transfer.

For income tax I would completely re-write the tax bands so that low earners pay zero tax, average to highish earners pay less, people earning $150-250k pay the same and introduce new bands for people earning over $250k, $500k, $1m etc - would benefit 99% of the population.

And take GST of healthy foods - like just about every other country does (but for some reason its too difficult for us

Must dash, lunch awaits....

Thanks for your reply. I don't really think a CGT or Wealth tax is the answer but otherwise agree with all you've said.Totally agree - I don't care whether its CGT, wealth or gift/inheritance but intergenerational wealth should be taxed.

For income tax I would completely re-write the tax bands so that low earners pay zero tax, average to highish earners pay less, people earning $150-250k pay the same and introduce new bands for people earning over $250k, $500k, $1m etc - would benefit 99% of the population.

And take GST of healthy foods - like just about every other country does (but for some reason its too difficult for us)

Must dash, lunch awaits....

Oh, and enjoy those carrot sticks

Sad to hear of the passing of Rod Oram, one of the best Business editors NZ has ever had. Loved the way he didn’t care who the government was…. it was his job to hold them to account whether the subject was business, the economy or the climate. Had the privilege of meeting him a few times. Definitely a top guy!!!

www.nzherald.co.nz

www.nzherald.co.nz

Obituary: Rod Oram - Champion of business, climate journalism and inaugural Business Herald editor

Oram was widely respected for his work and personal kindness.

That's terrible news! Really enjoyed his articles - a real blow for climate journalism in NZ.Sad to hear of the passing of Rod Oram, one of the best Business editors NZ has ever had. Loved the way he didn’t care who the government was…. it was his job to hold them to account whether the subject was business, the economy or the climate. Had the privilege of meeting him a few times. Definitely a top guy!!!

Obituary: Rod Oram - Champion of business, climate journalism and inaugural Business Herald editor

Oram was widely respected for his work and personal kindness.www.nzherald.co.nz

Last edited:

Man, it's hard dealing with banks at the moment.

We're wanting to put part of our mortgage on Interest Only for six months so that the amount we pay each fortnight remains the same. But, because there's a very slight possibility that the interest rates may not change enough, the bank is concerned that we may be forced to pay more at the end of that time and want us to go through an application process providing proof of income and expenses.

Of course, it's highly likely interest rates will have continued to drop and it won't be an issue.

The stupid thing is, if we continue to pay the entire loan as Principle and Interest, our fortnightly repayments will go up over $300 but the bank don't need proof of income and expenses to see if we can afford that.

How dumb is this? Provide them proof that we can afford to pay what we're already paying but give them no proof to pay them more.

We're wanting to put part of our mortgage on Interest Only for six months so that the amount we pay each fortnight remains the same. But, because there's a very slight possibility that the interest rates may not change enough, the bank is concerned that we may be forced to pay more at the end of that time and want us to go through an application process providing proof of income and expenses.

Of course, it's highly likely interest rates will have continued to drop and it won't be an issue.

The stupid thing is, if we continue to pay the entire loan as Principle and Interest, our fortnightly repayments will go up over $300 but the bank don't need proof of income and expenses to see if we can afford that.

How dumb is this? Provide them proof that we can afford to pay what we're already paying but give them no proof to pay them more.

Similar threads

Politics

🤡 Donald Trump

- Replies

- 7K

- Views

- 418K

Current Affairs

🗳️ Is this the twilight of democracy?

- Replies

- 160

- Views

- 32K

- Replies

- 3

- Views

- 3K