View: https://x.com/HicksKiwi/status/1898537122489082075

NZ and Māori were in Bill Maher’s sights a couple of days ago

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

It's getting to the point where it may be too risky going to an election with him in charge.Luxon’s gradually getting found out for what he’s about - which is nothing relevant to any of us. It’s going to be a fascinating watch.

He’s done a good job bringing stability to National but he lacks the charisma (and brains) to shine. Good manager rather than PM material.Luxon’s gradually getting found out for what he’s about - which is nothing relevant to any of us. It’s going to be a fascinating watch.

Agreed the polls will swing back once the economy is in recovery mode, however Luxon does need to go. Unfortunately the best replacement is still too young to be PM so it’s probably Chris Bishop…He’s done a good job bringing stability to National but he lacks the charisma (and brains) to shine. Good manager rather than PM material.

National will go up in the polls once the economy swings back later in the year but I think Luxons toast.

Who’s the replacement going to be?

2 new main party leaders fighting it out for the next election

Taxation reduces the disposable income of the non-government sector and thus reduces the capacity of that sector to make claims [purchases] on the productive resources available. The taxation creates unemployed productive resources, which can then be brought into productive use by the government spending within the inflation ceiling. (Mitchell, 2024)

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it. (Planck 1949, pp. 22-24).

I thought Willis was the natural next up but she’s getting a negative reputation and tainted with the ‘tough’ choices.Agreed the polls will swing back once the economy is in recovery mode, however Luxon does need to go. Unfortunately the best replacement is still too young to be PM so it’s probably Chris Bishop…

This is it all really:Some Useful Tools to Help You Rethink How Government Spending Works

How You'll Learn to Stop Worrying and Love the Self-Financing State

The old saying is that if it aint broke, don’t fix it. The way we think about government spending is beyond broken. So, today we take apart how government spending works and put it back together again.

You’ll get some ideas and frames - tools - of how to frame your own thoughts and conversations about how government spending actually works.

While the mechanics of government expenditure are all very complicated, there are concrete, simple to understand facts we can point to which show that the state is self-financing.

The facts are that:

By understanding these facts, we can appreciate that it doesn’t matter whether you are Nicola Willis or Barbara Edmonds, the Taxpayer’s Union or the Council of Trade Unions, a martian or a fish, the structure and mechanics of government spending are the same for everyone.

- every dollar the government spends is a new dollar (government spending increases the settlement cash level - Callaghan et al, 2023, p. 4)

- all New Zealand Government spending comes from the Crown Settlement Account. The Crown Settlement Account is the government’s disbursement account, the source of all government expenditure, and all spending between the government and non-government sector flows through this account (Frazer, 2004)

- the government settles its payments (i.e., makes and receives payments) with settlement cash (Huxley and Riddell, 1996, p. 309)

- the Reserve Bank has infinite control in determining the settlement cash level (Knowles et al, 2023, p. 3; Callaghan et al, 2023, p. 3)

- the New Zealand government issues its own currency and floats it freely on international foreign exchange markets

- the costs to government are represented through the availability of resources, not money

Taking It Apart

For many people, it is quite difficult to grasp the concept that the government faces no financial constraints. I don’t blame them. It isn’t helped by the simple (and entirely incorrect) frame that the government ‘is like a household’. This view is prevalent in all elements of society.

This masks a rather simple reality.

The government is not like a household.

All government expenditure comes from the Crown Settlement Account. The government spends settlement cash, the amount of which is determined by the Reserve Bank. The government creates its own money when it spends. In other words, every dollar it spends is a new dollar.

That’s it.

The government does not fund its expenditure through income (taxes, asset sales etc) and anything over its ‘income’ is not funded through issuing ‘debt’.

Here’s something to help solidify the idea of money creation from nothing (ex nihlo).

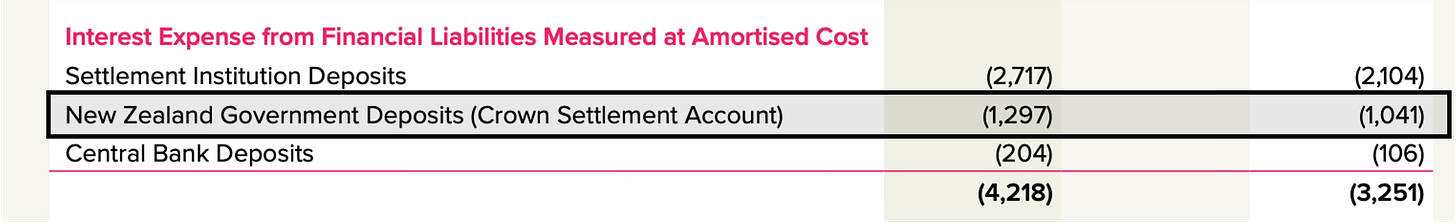

The Reserve Bank pays interest on positive overnight balances in the Crown Settlement Account. The Reserve Bank paid $1.297 billion NZD in interest to the New Zealand Government on government deposits held at the Reserve Bank for the 2024 Financial Year.

This table is from page 150 of the 2023/2024 Reserve Bank Annual Report. The numbers are in NZD millions. Finally, the number to the right is the interest expense for 2022/2023 (i.e., interest paid to the Government).

Where did this money come from?

The same place all other government money comes from – it was created on a keyboard.

For another example, have a look at the overdraft example from this post.

https://neweconomicmanagement.substack.com/p/how-the-new-zealand-government-spends

Putting It Together

Understanding these realities fundamentally alters our view of public policy. The headlines and news articles we are accustomed to reading on ‘widening deficits’, the Government ‘running out of money’ and ‘fiscal cliffs’ are shown to be ideological constructs. These frames are quite distant from economic fact. For example, the ‘widening deficit’ demonstrates that the government is spending more into the economy than what it is taking out in taxes.

In recognising the self-financing state, the public’s obsession with financial cost to the government is replaced by the availability of resources able to be used by the New Zealand Government. We can call this the resource cost. For instance, the cost of a good health system is represented through the availability of nurses, doctors, equipment and facilities. It is not determined by the amount of money in Health New Zealand’s bank account.

Moreover, the financial cost of a better health system is not ‘a burden on future generations’ or ‘running up debt on the national credit card’.

All government expenditure comes from the Crown Settlement Account. The government spends settlement cash, the amount of which is determined by the Reserve Bank.

This isn’t to say that all spending is good spending. Far from it. Fiscal responsibility is reframed to mean that the government makes responsible use of resources for present and future generations. Crowding out of resources could (likely would) lead to price increases in the short to medium term (i.e., inflation).

This also doesn’t mean that the desire to limit the size of government is evil. The desire to limit the size of government is an entirely legitimate action from an ideological position. It could even be an empirical position depending on what the economic context of the time is (i.e., if non-government sector spending is ‘running hot’).

If it is ‘the will of the people’ for the Government to limit its spending, then that is the way that it is. However, this must be understood in the context of the self-financing state – that the government cannot run out of money.

Nicola Willis could (and should) accept that the state is self-financing. In doing so however, she would have to justify her political decisions without saying that the government is running out of money.

Government bonds and taxes don’t ‘fund’ government expenditure either.

Government bonds (debt) are assets for investors in the non-government sector. In Tender No. 935, the New Zealand Debt Management Office (NZDMO) auctioned $500 million NZD worth of bonds at three varying maturities.

The NZDMO received $2.348 billion NZD in bids for these bonds.

This doesn’t reflect investor desire to fund government spending. Rather, this indicates a strong demand to hold bonds.

Why?

Because government bonds are default risk free assets. The government can’t run out of money as it creates new money when it spends. Buying these bonds ensures that investors will receive income from their investment.

Taxes are the destruction of money. Tax payments are settled into the Crown Settlement Account at the end of every day they are received thereby decreasing the overall settlement cash level. They are never used again after the end of day settlement.

However, taxes are still very important in our economic system. They enforce the Government’s use of the New Zealand Dollar. They are also a highly effective policy tool, influencing where money should, or shouldn’t be spent.

From Bill Mitchell:

Out With the Old…

The ideas here represent a marked departure from the way we’ve thought about government spending. These old ways of thinking hold us back from achieving political and social objectives and do not reflect reality at all.

The ideas and concepts here don’t advocate for a new system, but advocate for understanding the system as it exists currently. Understanding how it actually works presents huge implications for how we engage with politics and public policy.

By understanding how the government expenditure actually operates, we can put our knowledge to good use in ensuring that government contributes to a better society for all.

It is up to us to become familiar with how the system actually works and bring a dose of reality to how we think about government spending.

As Max Planck once put it:

Some Useful Tools to Help You Rethink How Government Spending Works

How You'll Learn to Stop Worrying and Love the Self-Financing Stateneweconomicmanagement.substack.com

Too young as in Simeon Brown. Regardless of what a couple of numpties on here spout, he’s very highly rated by a number of very senior business leaders & presents incredibly well for someone of his age. He’s a future PM.I thought Willis was the natural next up but she’s getting a negative reputation and tainted with the ‘tough’ choices.

Bishops would be more disliked and lacking charisma than Luxon. By ‘to young’ are you thinking Stanford?

Smokey, Mark Mitchell? Has the charisma, profile, ex police, generally well liked, had media experience? Seems a little light weight again though but that might be what the NZ public like?

I've read a number of articles on this before, which led to a discussion with one of my nieces who completed a double degree in law and economics and has since gone on to work for two (PCW and EY) of the three largest accounting firms in NZ.Some Useful Tools to Help You Rethink How Government Spending Works

How You'll Learn to Stop Worrying and Love the Self-Financing State

The old saying is that if it aint broke, don’t fix it. The way we think about government spending is beyond broken. So, today we take apart how government spending works and put it back together again.

You’ll get some ideas and frames - tools - of how to frame your own thoughts and conversations about how government spending actually works.

While the mechanics of government expenditure are all very complicated, there are concrete, simple to understand facts we can point to which show that the state is self-financing.

The facts are that:

By understanding these facts, we can appreciate that it doesn’t matter whether you are Nicola Willis or Barbara Edmonds, the Taxpayer’s Union or the Council of Trade Unions, a martian or a fish, the structure and mechanics of government spending are the same for everyone.

- every dollar the government spends is a new dollar (government spending increases the settlement cash level - Callaghan et al, 2023, p. 4)

- all New Zealand Government spending comes from the Crown Settlement Account. The Crown Settlement Account is the government’s disbursement account, the source of all government expenditure, and all spending between the government and non-government sector flows through this account (Frazer, 2004)

- the government settles its payments (i.e., makes and receives payments) with settlement cash (Huxley and Riddell, 1996, p. 309)

- the Reserve Bank has infinite control in determining the settlement cash level (Knowles et al, 2023, p. 3; Callaghan et al, 2023, p. 3)

- the New Zealand government issues its own currency and floats it freely on international foreign exchange markets

- the costs to government are represented through the availability of resources, not money

Taking It Apart

For many people, it is quite difficult to grasp the concept that the government faces no financial constraints. I don’t blame them. It isn’t helped by the simple (and entirely incorrect) frame that the government ‘is like a household’. This view is prevalent in all elements of society.

This masks a rather simple reality.

The government is not like a household.

All government expenditure comes from the Crown Settlement Account. The government spends settlement cash, the amount of which is determined by the Reserve Bank. The government creates its own money when it spends. In other words, every dollar it spends is a new dollar.

That’s it.

The government does not fund its expenditure through income (taxes, asset sales etc) and anything over its ‘income’ is not funded through issuing ‘debt’.

Here’s something to help solidify the idea of money creation from nothing (ex nihlo).

The Reserve Bank pays interest on positive overnight balances in the Crown Settlement Account. The Reserve Bank paid $1.297 billion NZD in interest to the New Zealand Government on government deposits held at the Reserve Bank for the 2024 Financial Year.

This table is from page 150 of the 2023/2024 Reserve Bank Annual Report. The numbers are in NZD millions. Finally, the number to the right is the interest expense for 2022/2023 (i.e., interest paid to the Government).

Where did this money come from?

The same place all other government money comes from – it was created on a keyboard.

For another example, have a look at the overdraft example from this post.

https://neweconomicmanagement.substack.com/p/how-the-new-zealand-government-spends

Putting It Together

Understanding these realities fundamentally alters our view of public policy. The headlines and news articles we are accustomed to reading on ‘widening deficits’, the Government ‘running out of money’ and ‘fiscal cliffs’ are shown to be ideological constructs. These frames are quite distant from economic fact. For example, the ‘widening deficit’ demonstrates that the government is spending more into the economy than what it is taking out in taxes.

In recognising the self-financing state, the public’s obsession with financial cost to the government is replaced by the availability of resources able to be used by the New Zealand Government. We can call this the resource cost. For instance, the cost of a good health system is represented through the availability of nurses, doctors, equipment and facilities. It is not determined by the amount of money in Health New Zealand’s bank account.

Moreover, the financial cost of a better health system is not ‘a burden on future generations’ or ‘running up debt on the national credit card’.

All government expenditure comes from the Crown Settlement Account. The government spends settlement cash, the amount of which is determined by the Reserve Bank.

This isn’t to say that all spending is good spending. Far from it. Fiscal responsibility is reframed to mean that the government makes responsible use of resources for present and future generations. Crowding out of resources could (likely would) lead to price increases in the short to medium term (i.e., inflation).

This also doesn’t mean that the desire to limit the size of government is evil. The desire to limit the size of government is an entirely legitimate action from an ideological position. It could even be an empirical position depending on what the economic context of the time is (i.e., if non-government sector spending is ‘running hot’).

If it is ‘the will of the people’ for the Government to limit its spending, then that is the way that it is. However, this must be understood in the context of the self-financing state – that the government cannot run out of money.

Nicola Willis could (and should) accept that the state is self-financing. In doing so however, she would have to justify her political decisions without saying that the government is running out of money.

Government bonds and taxes don’t ‘fund’ government expenditure either.

Government bonds (debt) are assets for investors in the non-government sector. In Tender No. 935, the New Zealand Debt Management Office (NZDMO) auctioned $500 million NZD worth of bonds at three varying maturities.

The NZDMO received $2.348 billion NZD in bids for these bonds.

This doesn’t reflect investor desire to fund government spending. Rather, this indicates a strong demand to hold bonds.

Why?

Because government bonds are default risk free assets. The government can’t run out of money as it creates new money when it spends. Buying these bonds ensures that investors will receive income from their investment.

Taxes are the destruction of money. Tax payments are settled into the Crown Settlement Account at the end of every day they are received thereby decreasing the overall settlement cash level. They are never used again after the end of day settlement.

However, taxes are still very important in our economic system. They enforce the Government’s use of the New Zealand Dollar. They are also a highly effective policy tool, influencing where money should, or shouldn’t be spent.

From Bill Mitchell:

Out With the Old…

The ideas here represent a marked departure from the way we’ve thought about government spending. These old ways of thinking hold us back from achieving political and social objectives and do not reflect reality at all.

The ideas and concepts here don’t advocate for a new system, but advocate for understanding the system as it exists currently. Understanding how it actually works presents huge implications for how we engage with politics and public policy.

By understanding how the government expenditure actually operates, we can put our knowledge to good use in ensuring that government contributes to a better society for all.

It is up to us to become familiar with how the system actually works and bring a dose of reality to how we think about government spending.

As Max Planck once put it:

Some Useful Tools to Help You Rethink How Government Spending Works

How You'll Learn to Stop Worrying and Love the Self-Financing Stateneweconomicmanagement.substack.com

I don’t even think the schools should be involvedIn a further nail into the coffin of Seymour's school lunch program, a business, Libelle Group, which has a contract with Compass Group to provide 125,000 school lunches daily, has gone into liquidation today.

Here's what I see should happen. The schools get paid by the education department a set amount each day per child and then they opt into an arrangement with Compass if they want them to supply the food or they go with another provider. If a school feels that the cost per meal should be higher, then they find funding for the difference.

The problem with Simeon Brown is that a lot of voters will perceive him as more conservative than Luxon. Where Key succeeded was that he was seen as being areligious and more "common man" than Brown or Luxon.Too young as in Simeon Brown. Regardless of what a couple of numpties on here spout, he’s very highly rated by a number of very senior business leaders & presents incredibly well for someone of his age. He’s a future PM.

You mean like it could be a parents job?I don’t even think the schools should be involved

They’re already struggling to actually teach

To be fair, that business provided many lunches via schools under Labours program, so they would have been in the shit as well. Just unfortunate.In a further nail into the coffin of Seymour's school lunch program, a business, Libelle Group, which has a contract with Compass Group to provide 125,000 school lunches daily, has gone into liquidation today.

Here's what I see should happen. The schools get paid by the education department a set amount each day per child and then they opt into an arrangement with Compass if they want them to supply the food or they go with another provider. If a school feels that the cost per meal should be higher, then they find funding for the difference.

Unfortunately there are some teachers who would welcome that opportunity....You mean like it could be a parents job?

Over in the UK they are getting teachers to monitor the kids brushing their teeth because the parents aren’t doing it properly.

How long till they start that here? Maybe we should get the teachers to go and tuck the kids into bed at night as well…

I’ve been active in the property market lately. No more sitting on the sidelines! FOMO’s coming - prices are about to skyrocket! Just got to beat those first home buyers!For those about to refix their loan, here's some advice about paying of the loan faster (saving interest)....

Six ways to pay off your home loan faster

Living a mortgage-free life can feel like a pipe dream, but applying these six strategies could help make it a reality – and much sooner than you think.www.bnz.co.nz